Pakistan’s Bold Move to Establish a Strategic Bitcoin Reserve

Pakistan Has Made a Historic Pivot by Announcing a Government-Led Strategic Bitcoin Reserve

Estimated reading time: 5 minutes

- Historic pivot from anti-crypto stance to a strategic Bitcoin reserve.

- Focus on financial inclusion for over 100 million unbanked citizens.

- 2,000 megawatts allocated for Bitcoin mining and AI data centers.

- Strategic partnerships, including collaboration with Binance’s Changpeng Zhao.

- Potential economic redefinition through digital finance innovation.

Table of Contents

- News Overview

- Significance for TokenX and the Market

- Technological Details

- Tokenomics and Potential Consequences

- Partnerships and Ecosystem Interaction

- Risks and Issues to Monitor

- Practical Takeaways and Recommendations

- Conclusion

News Overview

In a remarkable development, Pakistan’s strategy to establish a government-led Bitcoin reserve showcases an essential pivot from its earlier skepticism towards cryptocurrency. This initiative is designed as a long-term holding approach, intentionally distanced from the speculative nature of trading. Officials have made it clear; the bitcoins amassed will “never, ever be sold,” reinforcing the seriousness of their commitment to cryptocurrency as a strategic national asset.

The move suggests that Pakistan is aiming not just to harness Bitcoin for economic gains but also to foster a new ecosystem for digital finance. With careful resource management in place, the country is poised to position itself as a leader in the global digital currency narrative, notably by focusing on financial inclusion, increased energy production, and the establishment of a solid legal and regulatory framework for crypto operations. For more intricate details, you can check out the official announcement and further insights on the CoinMarketCap data.

Significance for TokenX and the Market

This pivot is akin to a dormant volcano waking up, signaling a new era for Pakistan that could reverberate across the cryptocurrency landscape like a shockwave. By integrating Bitcoin strategically, Pakistan not only enhances its economic prospects but also places itself among progressive nations that understand the potential of digital finance. The potential for Bitcoin to drive financial inclusion cannot be overstated, especially when one considers the staggering number of unbanked individuals.

While the Asian continent has seen some countries adopt a cautious stance towards cryptocurrency, Pakistan is throwing its hat into the ring, equipping itself to become a frontrunner in a burgeoning industry. As of now, market trends indicate an increasing interest in nations seeking financial revitalization through bitcoin utilization. In light of comparable models—like El Salvador’s embrace of Bitcoin as legal tender—countries are indeed re-evaluating their cryptocurrency strategies amidst a climate rich with opportunity.

Technological Details

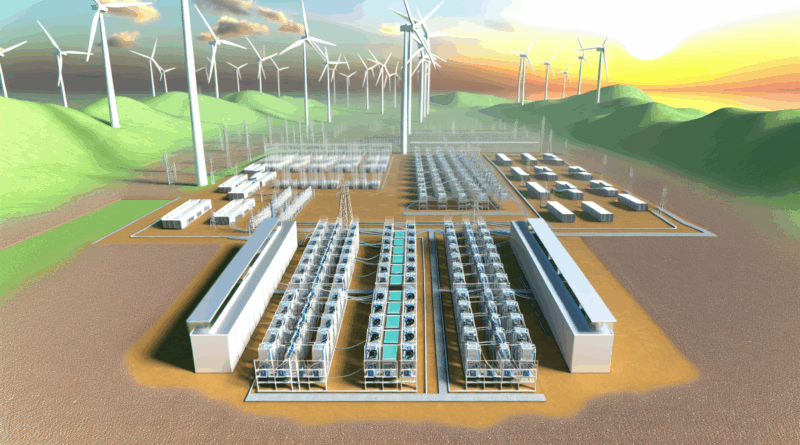

Imagine a sprawling landscape of Bitcoin mining facilities powered by surplus electricity, seamlessly integrating artificial intelligence into the nation’s economic fabric. Pakistan’s initiative does not merely glance at Bitcoin from a distance; it seeks to embed blockchain technology within its core economic operations. The government’s decision to allocate 2,000 megawatts for mining operations and AI data centers indicates a forward-thinking approach reminiscent of Silicon Valley’s tech boom.

By establishing infrastructure for Bitcoin and AI, Pakistan channels the power of two transformative technologies, potentially reshaping the myriad facets of its economy. These data centers will serve a dual purpose—a resource not just for Bitcoin, but also for advancing AI capabilities that can drive efficiency in numerous sectors. As various government functions transition into digital formats, this strategic innovation carries the promise of elevating Pakistan onto the global technological stage.

Tokenomics and Potential Consequences

With the establishment of a strategic Bitcoin reserve, Pakistan can potentially stimulate interest in digital assets domestically while cultivating a new economic segment. Tokenomics, a concept encapsulating the economic model underlying cryptocurrencies, indicates this initiative will likely influence demand and supply dynamics markedly. Imagine the digital landscape evolving as freely as a river, adapting to changes in supply; an influx of Bitcoin could drive up the perceived value of financial services and products, much like how a limited collectible card release drives up its price.

As of mid-2023, the trading volume of Bitcoin remains robust, and with this government endorsement, one can anticipate a boost in trading activity and perhaps new liquidity for digital assets in the region. Significant increases in transaction volumes could emerge, marking a shift in wealth dynamics—far akin to a seed growing into a bountiful tree.

Partnerships and Ecosystem Interaction

In the wake of this historic announcement, Pakistan has cultivated strategic relationships that are likely to broaden its economic landscape. With Changpeng Zhao advising the government, TokenX has now befriended one of the foremost figures in the cryptocurrency arena, potentially opening doors to further alliances and integrations. Imagine the possibilities; a robust network of international markets could soon converge in Pakistan, creating a nexus for investment and innovation.

As TokenX’s competitors remain wary, this strategic partnership will place Pakistan at a significant advantage, similar to how blockchain alliances have propelled countries like Malta and Singapore ahead in the global crypto race. The potential for collaboration between state entities and private sector players nurtures a unique ecosystem, one that could position Pakistan as a crucial player in the global cryptocurrency narrative.

Risks and Issues to Monitor

Despite the promising developments surrounding Pakistan’s Bitcoin reserve, there are potential risks that investors and stakeholders should observe closely. The challenge of infrastructure adequacy looms large; will the energy allocation truly meet the mining demands? The regulatory landscape is another area of concern; although a Digital Asset Authority has been established, navigating the uncertain regulatory waters amidst fluctuating government policies will require vigilant monitoring.

Additionally, global shifts in cryptocurrency regulations could impact Pakistan’s ambitions. Observing how international markets respond, particularly from major players like the U.S. and EU, will be essential. To stay on top of developments, consider following activity on GitHub for tech updates, or check Etherscan for real-time transaction statistics.

Practical Takeaways and Recommendations

If you’re keen to understand the implications of Pakistan’s strategic shift, here are some key areas to keep an eye on in the coming months:

- Energy Developments: Track the progression of infrastructure projects—such as the ramp-up of mining operations and AI data centers—as these will play a pivotal role in the success of this initiative.

- Market Movements: Monitor Bitcoin’s trading volume and price trends to gauge market sentiment regarding this novel approach to cryptocurrency adoption.

- Regulatory Developments: Follow the actions of the Digital Asset Authority, as new regulations could significantly influence both local and international perceptions of crypto usage in Pakistan.

For more insights into upcoming changes in cryptocurrency, see our previous articles on TokenX developments and other relevant trends.

Conclusion

In summary, Pakistan’s initiative to establish a government-led strategic Bitcoin reserve is more than a bold move; it has the potential to redefine economic pathways and elevate the nation within the realm of global digital finance. The embrace of Bitcoin not only signals a commitment to innovation but also a proactive approach to fostering inclusive financial systems. This news isn’t just another announcement; it could become a lighthouse guiding the country through the turbulent waters of cryptocurrency, and perhaps even inspiring other nations to consider a similar path toward economic revitalization and inclusion.

FAQ

**Q: What is the significance of Pakistan’s Bitcoin reserve?**

A: It marks a shift from skepticism to commitment in utilizing cryptocurrency as a strategic asset for economic development.

**Q: How does the government plan to support Bitcoin mining?**

A: By allocating 2,000 megawatts of electricity for mining and AI data centers.

**Q: Who is advising Pakistan on its cryptocurrency strategy?**

A: Binance co-founder Changpeng Zhao has joined as an adviser.

**Q: What are the potential risks associated with this initiative?**

A: Infrastructure adequacy, regulatory challenges, and international market responses are crucial areas to monitor.

Pingback: get enclomiphene toronto canada

Pingback: kamagra livraison sans ordonnance requise

Pingback: buying androxal price discount

Pingback: buying flexeril cyclobenzaprine uk how to get

Pingback: cheap dutasteride without a script

Pingback: canadian pharmacy generic gabapentin

Pingback: purchase fildena uk buy online

Pingback: online order itraconazole uk london

Pingback: cheap staxyn purchase singapore

Pingback: cheapest buy avodart uk how to get

Pingback: how to buy xifaxan no prescription overnight delivery

Pingback: order rifaximin uk suppliers

Pingback: jak získat recept na kamagra